What I Believe

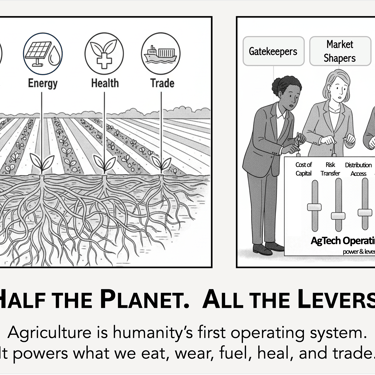

No single technology will define the next decade. Systems will.

The advantage will go to builders who can link science, capital, and policy and then execute via M&A, minority stake investments like venture capital, partnerships, and commercialization.

Industries bend when capital is paired with strategy and orchestration.

Defending yesterday is more risky than creating tomorrow.

The Problem I'm Tackling

The gap between "doing innovation" and "driving growth" is widening. Many corporates already "work with" startups… but it’s often siloed, or treated as vendor management or one-off pilots.

Startups move fast but struggle to scale through regulation, manufacturing, and distribution.

Corporates have reach and assets but struggle to move with speed and conviction.

Investors optimize for returns, often without building the strategic pathways that make adoption possible.

What’s missing is orchestration: connecting founders, corporate engines, and institutional capital into a repeatable flywheel.

My focus: helping science-driven sectors move faster - agriculture and bio, climate and energy, industrials, and health - where timelines are long, systems are complex, and the right structure unlocks disproportionate value.

Discover Mark

Select Board & Observer Roles:

AgroSpheres (RNAi and encapsulation, US), Micropep (peptide design, France), Niqo Robotics (robotics and automation, India), Premier Crop Systems (analytics, US), Solasta Bio (peptide discovery and design, UK), SP Ventures (early stage VC fund, Brazil), Traive Finance (AI-based credit and finance, Brazil).

Strategic Engagements (Interim):

Executive in Residence, North Carolina Biotechnology Center

Commercialization Board, Plant Science Initiative at NC State University

Venture Partner, LongLeaf Studios

Reviewer, NCInnovation Grants Program

Education:

MBA, concentration in entrepreneurship, NC State University

Graduate Certificate, Entrepreneurship & Technology Commercialization, NC State University

Graduate coursework in Biotechnology and Business, Harvard University

B.S. Meteorology, NC State University

I’ve built startups, allocated capital, served on boards, and led in complex global environments. That mix (operator + investor + corporate builder) lets me help organizations orchestrate innovation into repeatable growth across M&A, venture, and strategic partnerships, in regulated, science-driven industries.

See full experience on LinkedIn.

Career Highlights:

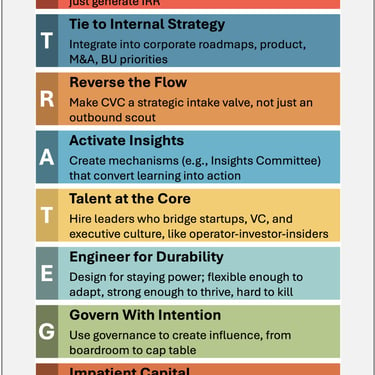

Corporate Venture & Innovation Platforms: Built and scaled three corporate innovation / VC programs across industrial, bio/ag, and financial sectors (including Fortune 500 environments). Deployed $75M+, catalyzed $250M+ in follow-on capital, and delivered 7 exits, including a $200M M&A outcome.

Corporate Development & Strategic Growth: Designed and executed build/buy/partner strategies, target screening, diligence, structuring, and value capture - helping science-based organizations translate innovation into measurable enterprise outcomes.

Founder / Operator Perspective: Cofounded and led a climate analytics startup; reached profitability within two years and captured 40% market share in a pilot region by selling decision-support tools to specialty crop growers.

Scientific Rigor: Former climate scientist with peer-reviewed publications and funded research; built climate-based decision support products used by practitioners and decision-makers.

Seeking New Leadership Opportunities

I am looking for my next leadership role in Corporate Development, External Innovation, or CVC within mid- to large-cap, science-driven organizations.

Roles I’m pursuing:

Head of Corporate Venture / VP Innovation / VP Corp Dev (science-driven company, mid to large cap);

Partner / Operating Partner at a climate, bio, or industrial-tech fund;

Commercialization / ecosystem leadership at a top-tier research university.

Sectors:

BioTech and Life Sciences • Industrials and infrastructure • AgTech and FoodTech • Energy transition • Climate

North star:

Build platforms that shape markets and strengthen resilience.

Recent Thought Leadership

A selection of interviews, talks, and writing on corporate venture, inorganic growth, and building innovation systems in regulated, science-driven industries.

For speaking inquiries, inquire about availability

Interviews

Featured in "10 practical tips for agri-tech start-ups in 2025" by Agri-TechE, September 5, 2025. link

Guest on the Caplander Podcast, August 25, 2025. link

Guest on the Modern Acre, episode 418, July 29, 2025. link

Appeared on the Charles Aris webinar - Seeding the future of Agtech, June 4, 2025. link

Featured in Software is Feeding the World, the strategic role of corporate VC, March 19, 2025. link

Speaking

Speaker in "Inside the Boardroom: What Works, What Breaks in Corporate Venture Capital," hosted by Trampoline VC, September 29, 2025.

Panelist at NY Climate Week, "Cultivating Alignment: Scaling Solutions to Reduce Fertilizer Emissions" hosted by PACT, Vere Initiatives, and the McKnight Foundation, September 24, 2025. link

Panelist and Moderator at the Santa Fe Business Forum, Rosario, Argentina, September 2-3, 2025. link

Speech at the 9th Microbiome AgBioTech Summit, Raleigh, NC, "Fast Capital, Slow Science: Why We’re Starving the Next AgBio Revolution," August 26, 2025.

Panelist in a Congressional Briefing about AgTech, hosted by Congresswoman Budzinski (D-IL) and the House Committee on Agriculture, Washington DC, June 25, 2025. link

Spoke at the Bonny Doon Insights Forum, Santa Cruz, “Why CVCs fail,” May 14, 2025. link

Panelist at the Agri-Venture Forum, Toronto, Corporate Strategics in AgTech, May 8, 2025.

Keynote speaker, Africa Agri-Tech Conference, “Funding 2040 and Beyond,” Pretoria, South Africa, March 20, 2025. link

Writing

"The Underpriced Cycle Beneath Food and Ag" AgfunderNews, to be published in 2026.

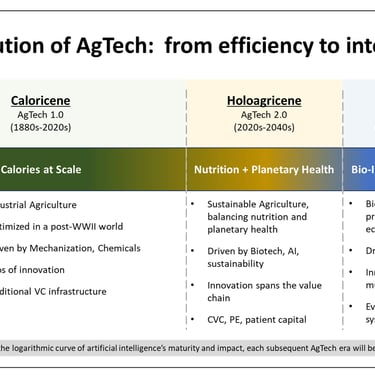

"AgTech is Dead. Long Live the System." AgfunderNews, November 5, 2025. link

"When rebuilding the bridge, founders and funders can’t afford the ‘slow maybe’", AgfunderNews, September 22, 2025. link

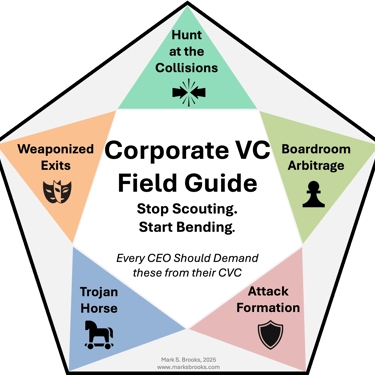

"Five ways startup investment can bend markets," Global Corporate Venturing, September 19, 2025. link

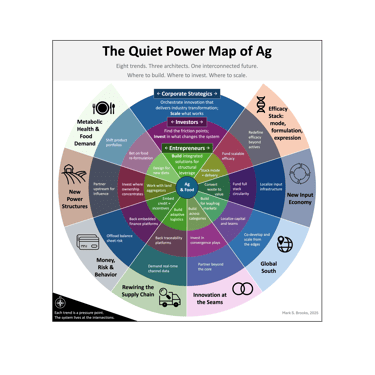

“The Quiet Trends Reshaping Ag and Food,” AgFunderNews, June 23, 2025. link

“AgTech x AGI: The Convergence That Changes Everything,” AgTechNavigator, June 16, 2025. link

“The end of Corporate Venture Capital as we know it,” Global Corporate Venturing, June 11, 2025. link

"How to unlock trillion-dollar opportunities in agrifood and climate,” AgFunderNews, March 12, 2025. link

“Why agtech needs new capital models… and investors who can keep up,” AgFunderNews, January 7, 2025. link

Contact Mark

Join my Newsletter

I share occasional notes on innovation + corporate development in regulated, science-driven industries—deal flow, frameworks, and market perspective. ~1 email every 3–5 months. No spam.